Resources

401(k)

Principal

1 (800) 547-7754

www.principal.com

Contributions to the 401(k) Plan

- You may contribute up to the IRS maximum. The maximum amount you may defer for 2025 is $23,500.

- Employer Match Contribution: 100% up to 6% of deferrals

- Your plan also accepts rollovers from other qualified plans & IRA’s

- Eligibility: Age 20 ½ & 6 months of service

- Entry Dates: 1/1, 4/1, 7/1 & 10/1

- You may change your contributions by visiting www.principal.com or (800) 547-7754

- Automatic Enrollment 3%

- Employer Discretionary Profit-Sharing Contribution

Distributions from the 401(k) Plan

You may take a distribution at:

- Retirement (NRA 65)

- Death

- Disability

- Separation from service

- Age 59 ½ In Service

Options Include:

- Cash Distribution

- Rollover to IRA

- Rollover to qualified plan

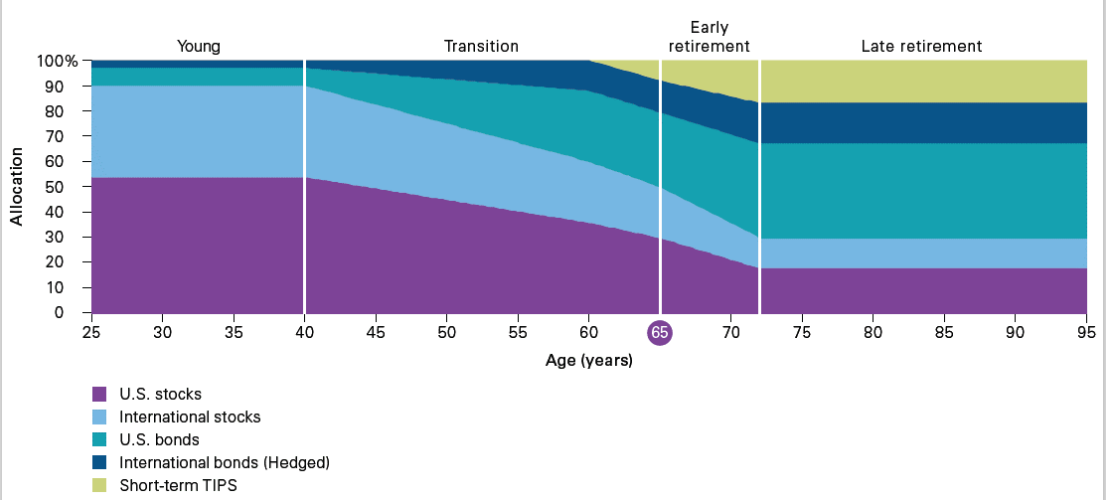

Target Date Funds

Your plan offers target-date portfolios. Each portfolio is: Diversified, Automatically Rebalanced, an Age-based Allocation, meant to be diversified investment option and has passive index funds underlying. Professionally managed and diversified across investment styles. A single, complete investment option based on a specific retirement year. Adjusted toward a more conservative risk level over time.